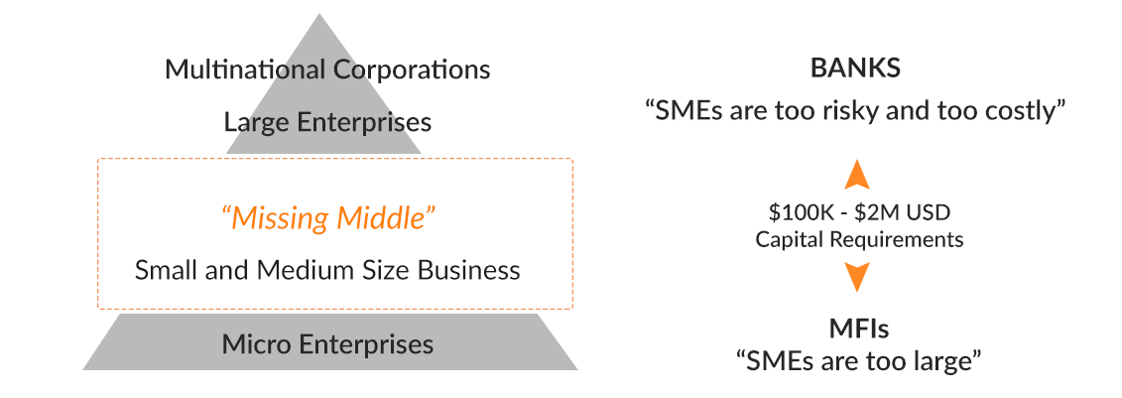

Missing Middle

Small and medium enterprises (SMEs) are the economic backbone of virtually every economy in the world. SMEs represent more than 95% of registered firms worldwide, account for more than 50% of jobs, and contribute more than 35% of Gross Domestic Product (GDP) in many emerging markets.

Small businesses generate most of the new jobs, and help diversify a country’s economic base. They also promote innovation, help deliver goods and services, and can be a powerful force for integrating women and youth into the economic mainstream. Yet despite all these benefits, small enterprises remain significantly underserved by financial institutions. Worldbank research indicates that the credit gap that formal SMEs confront is about $1 trillion.

It is precisely the Missing Middle segment where the FACTS business model is most relevant, and where we make our biggest impact. Through working with SMEs processors, who act as BUYER/SELLER, we ensure that their suppliers and off-takers will receive early- or [respectively] late payment. By doing so we provide these small businesses with the “access to finance” that they are lacking today.

Access to Finance

The FACTS business model does not require collateral and financials from suppliers, and only limited information from off-takers. As such we deviate from the traditional SME banking model.

In supplier finance we shift (re)payment risk to the SMEs processor (= buyer) which are normally stronger entities within value chains. And in case of distributor finance, we rely on a portfolio of assigned receivables, whilst maintaining recourse on the SME processor (= seller). Our financing bridges the critical 60-90 days liquidity gap, and allows suppliers and off-takers to plan and execute their next trade or transaction. This creates a multiplier effect, allowing for more sales, business growth and ultimately job creation.

Creating Impact

For us Impact is about building better and stronger SMEs that can compete in the global market place. It is about import substitution for daily products and necessities, about job creation, increased wages, education and training, enhanced fiscal footprint and contributing towards more resilient communities. Through our approach we PULL suppliers and (smaller) off-takers into the formal economy and assist in building stronger value chains.

In the Agriculture sectors we work with NGO’s to actively engage farmers and other suppliers: Coops, Service Centers, (larger) farmer groups can be onboarded onto our platform immediately start benefitting from our financing products.

In the private health sector we work with the Medical Credit Fund and other partners to help private healthcare institutions access affordable finance to improve the quality of healthcare they deliver.